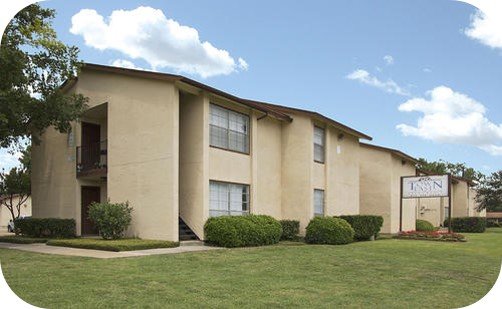

Investors Can Own a Piece of This Property and Future Properties Through the Impact Housing REIT Offering; To Learn More About This Investment Opportunity, Register for a Live CrowdStreet Webinar Here

LOS ANGELES, CA / March 8, 2018 / ImpactHousing.com is a new social impact Real Estate Investment Trust (REIT) on a mission to purchase and transform old, neglected and/or mismanaged apartment communities nationwide while keeping them affordable for low and middle-income residents. The REIT is set to acquire its first multifamily apartment community, a twelve-story, 143-unit high rise located in Southern Maryland, just outside Washington D.C., alongside a group of sophisticated real estate investors who have already committed over $5.5 million to the project. Currently, at 96% occupancy, this apartment community is categorized as a “Naturally Occurring Affordable Housing” (NOAH) asset, which means it’s affordable for those with incomes at or less than 80% of Area Median Income (AMI).

Under the direction of Impact Housing REIT’s Founder, Eddie Lorin, an Affordable Housing Preservationist, the Company plans to keep it that way – affordable for hard-working individuals and families, while delivering positive financial, social and environmental (“Triple Bottom Line”) returns to investors through low cost, high value aesthetic and eco-friendly interior and exterior improvements, and free onsite after-school activities, fitness classes, health and wellness programming through its non-profit partner, the Healthy Apartment Property Initiative (HAPI) Foundation.

For a brief video overview of the Southern Maryland investment opportunity, click here. To read about it in more detail on the Company’s website, click here.

“Not only is this asset a ‘diamond in the rough’ socially responsible investment (SRI) that has the potential for the same great financial returns we’ve achieved in past for institutional and private investors, but also it helps solve a real problem in our country. The lack of quality housing that’s affordable is a real problem that affects all facets of our society,” commented Eddie Lorin, Founder of Impact Housing REIT and its Sponsor Strategic Realty Holdings LLC.

Lorin added, “We’re doing our part by deeming this first investment in Maryland – just outside our nation’s capital – affordable, and by allowing anyone and everyone to invest alongside us. To make sure everyone has an opportunity to invest, not just the wealthy, we’ve reduced the minimum investment to $1,000 for this project. We welcome investors across the globe to co-invest with us in what we believe will be the first of many impact-driven socially responsible investments in the workforce housing multifamily sector.”

Management will be hosting a live online Update Webinar Friday, March 16th, from 1:00 PM – 2:00 PM EST / 10:00 AM – 11:00 AM PST to discuss the project, the investment opportunity and the roadmap for 2018 before opening the event to Q&A. Current and potential Impact Housing REIT and CrowdStreet investors are welcome to attend for free. To register for the event, click here.

Impact Housing REIT’s Sponsor, Strategic Realty Holdings, has an impressive track record. Over the past 9 years, their team acquired 72 multifamily properties similar to Southern Maryland. Of those properties, 40 have completed their full investment cycle from acquisition to renovation to lease-up to sale, and on average, achieved:

- 48% increase in Net Income

- Annual cash on cash returns of 8.55%

- Annual Internal Rates of returns averaging 24.77%

Note: Past performance does not guarantee future results. This property may or may not ultimately close escrow subject to due diligence and other various factors. Impact Housing REIT cannot guarantee that this specific property will end up being one of the multiple assets owned by the fund.

With a lower minimum investment, Impact Housing REIT has made it possible for any person, foundation, corporation, family office, a fund that’s committed to socially responsible investing – to earn real returns that help solve real problems. See more on how to invest, click here. If you would like to join our effort and invest alongside us in what we expect will be the first of many impact-driven multifamily investments, please visit ImpactHousing.com or email us at invest@ImpactHousing.com.

About Impact Housing REIT, LLC

Impact Housing REIT, LLC is a company founded by Edward (“Eddie”) P. Lorin, a 30-year multifamily real estate veteran, focusing primarily on value-add and/or under-performing multifamily properties nationwide. Since 2001, the Impact Housing management team has participated, as Principal or Advisor, in the purchase and transformation of more than $3 Billion worth of multifamily real estate amounting to more than 180 communities with approximately 40,000 apartment units nationwide. For more information on Impact Housing REIT, visit: ImpactHousing.com, watch our video, like us on Facebook, follow us on LinkedIn and Twitter at @theGOODREIT

Read more: http://www.digitaljournal.com/pr/3688814#ixzz59XzZekBH

Every day across America, individuals and families are looking for clean, safe houses and apartments that are affordable, a term the U.S. Department of Housing and Urban Development defines as “housing for which the occupant(s) is/are paying no more than 30 percent of his or her income for gross housing costs, including utilities.” Homes that are affordable are a necessary and tangible asset for any adult or family to survive and thrive, but there simply aren’t enough of them to go around.

Every day across America, individuals and families are looking for clean, safe houses and apartments that are affordable, a term the U.S. Department of Housing and Urban Development defines as “housing for which the occupant(s) is/are paying no more than 30 percent of his or her income for gross housing costs, including utilities.” Homes that are affordable are a necessary and tangible asset for any adult or family to survive and thrive, but there simply aren’t enough of them to go around.