Impact Housing REIT Makes Top 14 Non-Accredited Real Estate Crowdfunding Sites

Impact Housing REIT, LLC (ImpactHousing.com) made The Real Estate Crowdfunding Review’s 2017-2018 Top 14 Nonaccredited Real Estate Crowdfunding Sites, receiving Industry Honors for Most Experienced Sponsors, and Most Socially Conscious, the only award given in the category.

Note: The minimum for consideration are principals with $2B+ previous total real estate experience and $100m+ previous experience in current fund strategy and real estate asset.

In their full review, The Real Estate Crowdfunding Review states the team’s acquisition and transformation of “over $3 billion in multifamily properties since 2001 (either as principal or advisor), and raised approximately $260M from private investors” as well as its partnership with the “Healthy Apartment Property Initiative (HAPI) Foundation (http://www.hapiapt.org/), a 501C-3 non-profit, to provide free food and health and wellness programming, as well as fitness education and activities to kids and families living in its communities” as what earned Impact Housing its Industry Honors.

“On behalf of our entire team, we are thrilled to be named among the top 14 real estate crowdfunding companies for non-accredited investors and to be awarded not one but two very important Industry Honors by The Real Estate Crowdfunding Review. Their independent review and recognition of our strong track record and commitment to social good is extremely gratifying and encouraging. We look forward to continuing our capital raise and to delivering returns to both investors and residents in our future communities in the time ahead,” commented Eddie Lorin, Founder of Impact Housing REIT.

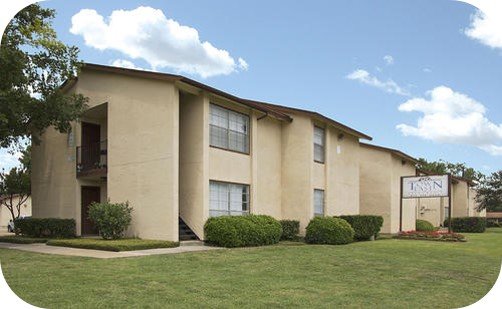

To view the investment offering including prospective acquisitions, visit https://invest.impacthousing.com/properties/impact-housing-reit/.

Disclaimer: Prior performance does not guaranty future results. An investment in Impact Housing REIT, LLC involves significant risks. For more information, see our Offering Circular.

About Impact Housing REIT, LLC

Impact Housing REIT, LLC is a company newly founded by Edward (“Eddie”) P. Lorin, a 30-year multifamily real estate veteran, focusing primarily on value-add and/or under-performing multifamily properties nationwide. Since 2001, the Impact Housing management team, has participated, as Principal or Advisor, in the purchase and transformation of more than $3 Billion worth of multifamily real estate amounting to more than 180 communities with approximately 40,000 apartment units nationwide. For more information on Impact Housing REIT, visit: www.ImpactHousing.com, watch our video, like us on Facebook, follow us on LinkedIn and Twitter at @theGOODREIT.