How You Can Help Fix America’s Affordable Housing Crisis – Originally Published in Forbes

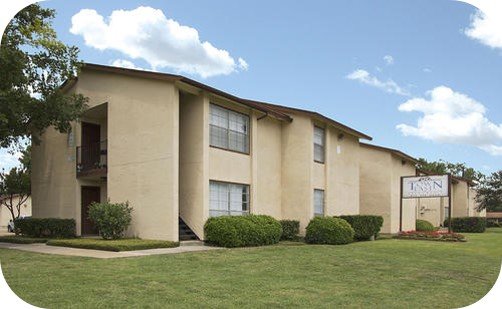

Every day across America, individuals and families are looking for clean, safe houses and apartments that are affordable, a term the U.S. Department of Housing and Urban Development defines as “housing for which the occupant(s) is/are paying no more than 30 percent of his or her income for gross housing costs, including utilities.” Homes that are affordable are a necessary and tangible asset for any adult or family to survive and thrive, but there simply aren’t enough of them to go around.

Every day across America, individuals and families are looking for clean, safe houses and apartments that are affordable, a term the U.S. Department of Housing and Urban Development defines as “housing for which the occupant(s) is/are paying no more than 30 percent of his or her income for gross housing costs, including utilities.” Homes that are affordable are a necessary and tangible asset for any adult or family to survive and thrive, but there simply aren’t enough of them to go around.

Federal Reserve findings indicate a growing percentage of renters are either cost-burdened or extremely cost-burdened by rising rents and stagnating incomes. The Joint Center for Housing Studies (JCHS) of Harvard University published a 2017 study that found more than one-third of U.S. households were rental units. The research further suggests that overall household growth will be strong over the next decade as larger numbers of the extremely large millennial generation move out on their own — therefore pushing the number of households in our country, higher.

So what can we do? Eddie Lorin, Member of the Forbes Real Estate Council, presents to ForbesCommunityVoice readers a few ways we can help fix the housing affordability crisis (and potentially earn financial returns along the way).

Since the jobs act of 2012, there have been many changes to securities laws. One of these changes has resulted in companies being able to raise capital through non accredited investors without going through the entire IPO process. The rule is called Reg A+ and although it is relatively new to the real estate sector many companies are utilizing the Reg A process to raise capital.

Since the jobs act of 2012, there have been many changes to securities laws. One of these changes has resulted in companies being able to raise capital through non accredited investors without going through the entire IPO process. The rule is called Reg A+ and although it is relatively new to the real estate sector many companies are utilizing the Reg A process to raise capital.

On the Ambitious Entrepreneur with Annemarie Cross Podcast, Eddie Lorin shares how can you make a difference in the world WHILE making money; the first of its kind Investment Opportunity “ Impact Housing REIT; and the Impact Meets Real Estate Investment Strategy.

On the Ambitious Entrepreneur with Annemarie Cross Podcast, Eddie Lorin shares how can you make a difference in the world WHILE making money; the first of its kind Investment Opportunity “ Impact Housing REIT; and the Impact Meets Real Estate Investment Strategy.