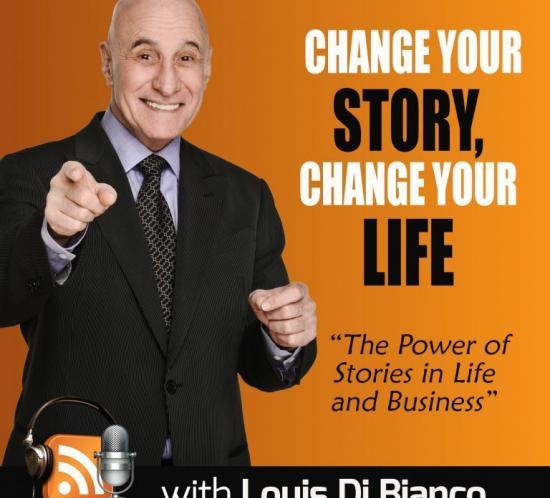

Change Your Story, Change Your Life: Create Your Reality with Eddie Lorin

Eddie recently sat down with Louis Di Bianco host of “Change Your Story, Change Your Life” for an in-depth and very personal discussion about the importance of self-empowerment, overcoming obstacles, rising to challenges, and how to create your own reality. Overarching themes: You can run from challenges, or make friends with them. Choose the latter, and you will create your reality. Actually, you always create your reality. When you embrace all challenges, you create the reality you want.

Eddie recently sat down with Louis Di Bianco host of “Change Your Story, Change Your Life” for an in-depth and very personal discussion about the importance of self-empowerment, overcoming obstacles, rising to challenges, and how to create your own reality. Overarching themes: You can run from challenges, or make friends with them. Choose the latter, and you will create your reality. Actually, you always create your reality. When you embrace all challenges, you create the reality you want.

Powerful lessons and takeaways:

- A message of hope and forgiveness from a holocaust survivor

- The power of the Serenity Prayer

- The rich meaning of Impact Investing (Read more.)

- How to create wealth through contribution

- How to develop an abundance mindset

- How to turn blight into light

- Luxurious living on a budget

- Slashing taxes with Opportunity Zones

- Why you should be thankful for what you don’t have

Louis created Change Your Story, Change Your Life podcast everyone to learn how to tap into and harness storytelling power to enrich personal and business growth. The people interviewed offer golden insights that help break through limiting beliefs. You will learn to truly step into your personal and financial power. You will be able to reinvent yourself on command.

On the Ambitious Entrepreneur with Annemarie Cross Podcast, Eddie Lorin shares how can you make a difference in the world WHILE making money; the first of its kind Investment Opportunity “ Impact Housing REIT; and the Impact Meets Real Estate Investment Strategy.

On the Ambitious Entrepreneur with Annemarie Cross Podcast, Eddie Lorin shares how can you make a difference in the world WHILE making money; the first of its kind Investment Opportunity “ Impact Housing REIT; and the Impact Meets Real Estate Investment Strategy.

Eddie guest interviews on The Sure Investing Podcast, from the makers of the

Eddie guest interviews on The Sure Investing Podcast, from the makers of the