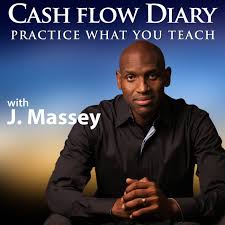

Cash Flow Diary Podcast: Eddie Lorin on Having a Vision in Real Estate

Eddie Lorin sits down with full-time real estate investor, entrepreneur, author, speaker, coach, all-around problem solver, and Cash Flow Diary podcast host, J. Massey, well known for providing best-in-class advice and strategies to help new and experienced investors the world over. In episode #478, Eddie shares his experience, his empathic observation of the working poor, opinion on the inflated housing market and his vision of wanting to make a difference in the world. Eddie’s mission is to provide clean, safe, and affordable housing for working class and to include all types of investors on his journey. He does this through Impact Housing REIT.

Having a vision in the real estate industry wasn’t the easiest road to take when he started in real estate. While trying to make a name for himself in the industry, there were so many bumps on the road he had to pass through. He learned that he had to be firm and also respectful to get his message across.

If one thing was made clear during those times, it was the fact that real estate is where he needed to be. At first, he tried dealing with commercial and industrial properties. But then he discovered that in multifamily business he can make a lot of money and at the same time help the masses. And thus, the birth of Impact Housing. Eddie says that his ultimate gift is having a vision in renovation. Just one look at an old property, he already knows how to turn it into something different. He says that he finds those properties through his connections or a brokerage community.

For the future entrepreneur who’s about to enter real estate, Eddie Lorin advises that you look for appreciative capital. Go for people who are going to appreciate you and what you do. Make sure they are on the same page as you do. Also, investing has more impact if people who are really in need will be the ones who’ll benefit.

If you’re still on the fence, Eddie says to let go and remember that fear is not rational. Whatever you’re compelled to do, if it’s sound and you’ve done your research, get ready to bounce and let go. If you don’t let go, it will keep you from being who you want to be.

Since the jobs act of 2012, there have been many changes to securities laws. One of these changes has resulted in companies being able to raise capital through non accredited investors without going through the entire IPO process. The rule is called Reg A+ and although it is relatively new to the real estate sector many companies are utilizing the Reg A process to raise capital.

Since the jobs act of 2012, there have been many changes to securities laws. One of these changes has resulted in companies being able to raise capital through non accredited investors without going through the entire IPO process. The rule is called Reg A+ and although it is relatively new to the real estate sector many companies are utilizing the Reg A process to raise capital.

Flipping America Show hosted by Roger Blankenship interviews Eddie Lorin on impact real estate and Impact Housing REIT. The show touches on all asset classes, investing strategies, and deal structures. From residential fix and flip, to commercial and industrial to mini-storage and mobile home parks, this show covers it all. The research team combs through mountains of market reports, demographic data, economic indicators, and trend news from a variety of sources so you won’t have to. PLUS, Roger includes how-to information in nearly every show, much of which is delivered as answers to questions.

Flipping America Show hosted by Roger Blankenship interviews Eddie Lorin on impact real estate and Impact Housing REIT. The show touches on all asset classes, investing strategies, and deal structures. From residential fix and flip, to commercial and industrial to mini-storage and mobile home parks, this show covers it all. The research team combs through mountains of market reports, demographic data, economic indicators, and trend news from a variety of sources so you won’t have to. PLUS, Roger includes how-to information in nearly every show, much of which is delivered as answers to questions.